Nepal’s commercial banks have shared their latest financial results for the first quarter of the current year. Most banks waited until the last official day to reveal their numbers.

- Some banks made less profit compared to last year

- A few improved in key parts of their business

- Overall, the banking sector faced ups and downs some strong results, some drops

Nepal Bank: mixed signals

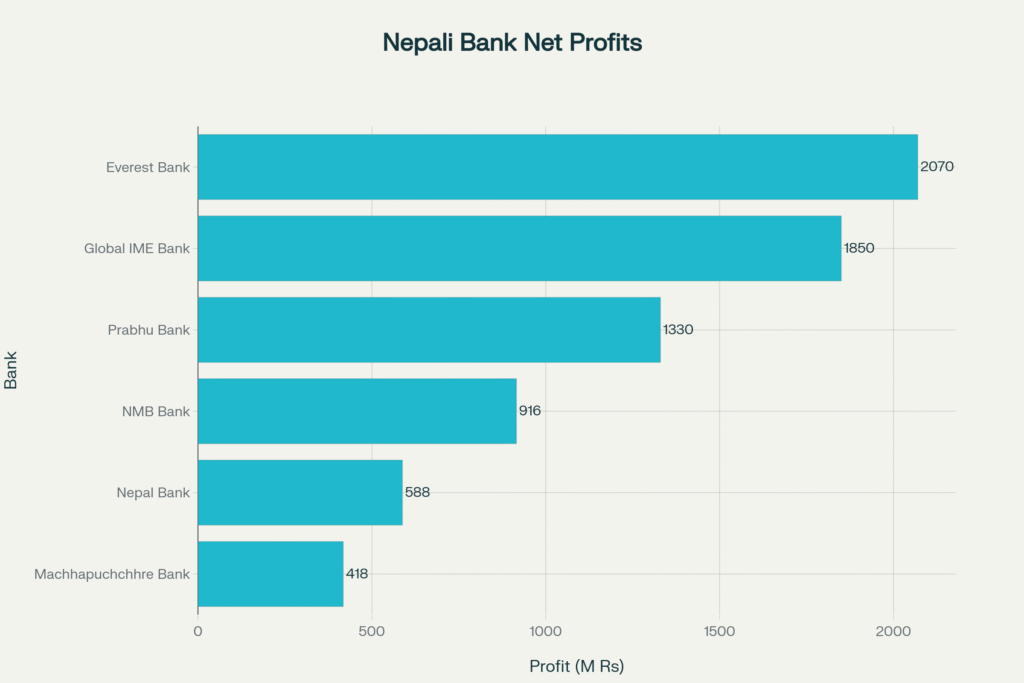

Nepal Bank‘s net profit and earnings per share went down a bit. In the first three months, it made about 588 million rupees in net profit, which is 2.31% less than last year. However, its net interest income grew by over 16%. Fee and commission income dropped, and its distributable profit turned negative.

NMB Bank: profits fell

NMB Bank earned about 915.9 million rupees in net profit—down by 20% compared to last year. Interest income increased, but heavier impairment charges pushed profits lower.

Kumari Bank: slightly down

Kumari Bank’s interest income rose, but overall profits and operational income fell slightly compared to last year. Their earnings per share also went down a little.

Prabhu Bank: steep climb

Prabhu Bank is having a great quarter. Net profit grew by 85% to around 1.33 billion rupees. Lower impairment charges helped boost their earnings.

Everest Bank: steady growth

Everest Bank’s net profit went up by 21%. Their interest and commission income also rose. Operational profits saw healthy increases, with good growth in earnings per share.

Global IME Bank: positive momentum

Global IME Bank’s net profit surged by 22% to about 1.85 billion rupees. Distributable profit increased, showing strong financial health.

Machhapuchchhre Bank: profits dropped

Machhapuchchhre Bank’s net profit went down by almost 17% compared to last year. Lower interest income and higher impairment charges hurt their performance.

Laxmi Sunrise Bank: mixed changes

Laxmi Sunrise Bank made a big leap in distributable profit, yet net profit dropped by 38%. Interest income slightly grew, but operational profit fell.

Nabil Bank: profit slipped

Nabil Bank earned about 1.75 billion rupees, 14.5% less than last year. Interest income fell, and impairment charges increased.

While some banks posted impressive results, others struggled with profit drops or weaker returns. Factors like changes in interest income, operational costs, and impairment charges played big roles in these outcomes.

Nepal’s banking sector is navigating through challenges and change. Investors and deposit holders should keep an eye on quarterly trends to make smart choices.